Tax Cases

Canada Revenue Agency (CRA) administers tax-related legislations such as the Income Tax Act, the Excise Tax Act and the Employment Insurance Act. Laws are legislated in the Parliament and are interpreted by case law. We archive tax related cases that we considered informative to our clients and browsers. Please feel free to submit court decisions on tax laws that you think our browsers may be interested to read.

While CRA recognizes that taxpayers' right to minimize tax liability within the parameters of law, aggressively pushing the limits creates a risk of crossing the line between acceptable tax planning and what is considered abusive tax planning. Technically, abusive tax planning may have some legal basis but have gone beyond the legislative intent. In general, abusive tax planning avoid paying the required taxes, and thus infringing law. These plans may include tax shelters, tax havens or outright tax avoidance. Taxpayers found using illegitimate schemes are penalized and sometimes prosecuted criminally.

|

On the other hand, CRA aggressively pursues taxpayers and at times infringe their rights under the Charter or the related acts. Sir Richard John Cartwright, Canadian Dominion Minister of Finance said the following in his 1878 Budget Speech:

|

"All taxation is a loss per se. It is the sacred duty of the government to take only from the people what is necessary to the proper discharge of the public service; and that taxation in any other mode, is simply in one shape or another, legalized robbery."

|

To ensure equity, it is important to maintain a balance of power between tax authorities and the rights of taxpayers.

Please click the case titles (arranged in descending chronological order) below to view the case synopsis and the related links.

|

Gangnon v. Canada [dispute of interest in arrears on a miscalculated spousal RRSP payment, court awarded costs to taxpayers challenging CRA's position]

|

Gangnon v. Canada (National Revenue) 2010 FC 155

Federal Court Judge Roger T. Hughes awarded a retired couple Robert Gangnon and his wife Margaret, both 70 as of February 21, 2010, who live in Ajax, Ontario costs of $1,200 in their dispute of $950 interest in arrears on a miscalculated spousal RRSP payment. Their legal battle lasted 5 years. CRA maintains its position and decides to drag this case before court.

This case demonstrates the following:

-

The legal and court costs in pursuing the Gangnons highly exceeds the dispute amount ($950). It appears that CRA bureaucrats are fighting this case on principle in maintaining its absolute authority in imposing interest and penalties.

-

Court has little or no power in restricting CRA's discretion in imposing interest and penalties.

-

Taxpayers are often forced into a dilemma of incurring much higher legal costs to challenge a government agency with unlimited resources if they think that they have been wronged.

[archived on March 6, 2010]

|

|

Neumann v. Canada (Attorney General), 2009 BCSC 324 [violation of privacy: unreasonable, unnecessary search and seizure breaching charter rights]

|

|

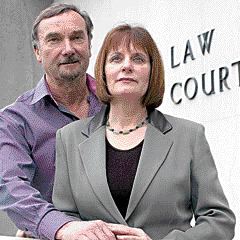

Hal Neumann of Saanich, B.C. was never the subject of a CRA investigation, but an innocent third party. In 2004, his business went through a successful audit. During the audit, the CRA learned that Leah Bonnar, an Alberta woman with whom Neumann did business with, had received commission cheques from him. She became the focus of a CRA tax-evasion investigation. Neumann gave the auditor his original documents concerning Bonnar.

Neumann was at home on September 7, 2005, when he saw the police cars. When he answered the door, a CRA investigator told him she had a warrant to search his home for records regarding the Bonnar investigation. Neumann complied with orders to show all the cash he had in the house and data stored in his computer at home. Neumann felt bullied and terrorized in his own home by the activities of CRA. He launched a civil suit against the Attorney General of Canada and the CRA to seek damages for suffering from depression, paranoia and post-traumatic stress disorder ever since.

A B.C. Supreme Court jury awarded Neumann $1.3 million in damages and costs on Scale B after finding the CRA search violated his privacy.

|

As of April 2010, the CRA has been appealing the decision. In a written statement to CBC, CRA alleged:

"The CRA has checks and balances in place to ensure that the quality of work and the conduct of its auditors and investigators meets the highest standards of professionalism. The CRA also has a Quality Assurance Division to promote consistent application of standards of quality in all audit programs. While executing searches, investigators are expected to abide by the proper procedures and practices. Everyone participating in the execution of a search warrant must conduct themselves in a professional manner. CRA investigators are advised to remain courteous, tactful and to exercise good judgment and common sense throughout the search." (source: CBC Radio April 9, 2010)

[Archived on April 20, 2009, last revised on May 6, 2010.]

|

|

Lipson v. Canada, 2009 SCC 1 [Tax avoidance: Whether GAAR applicable to deny tax benefits: Abuse and misuse of Income Tax Act, R.S.C. 1985, c. 1 (5th Supp.), s. 245(4)]

|

|

The Supreme Court of Canada handed down a split decision and denied Earl Lipson's appeal to deduct interest on a home mortgage for income tax purposes. Mr. Lipton took the following steps to establish a scheme that he believed will render mortgage interest paid for his home deductible:

- Mrs. Jordanna Lipson obtained a demand loan and purchased shares of the family's company from Mr. Lipson. Since the direct use of the funds was to buy the investment, interest on this loan would be deductible.

- Mr. Lipson then used the funds to buy the home.

- The couple took out permanent financing secured by a mortgage from a bank for $562,500 on the new home, and used the proceeds to repay the demand loan the same day. Under a specific tax rule, a new loan will be treated in the same way as the loan it replaces when determining whether interest is deductible.

The Court held that using spousal rollover and thereby triggering the income attribution rules through a series of transactions they created was an abuse. However, it would seem inappropriate for CRA to use general anti-avoidance rule (GAAR) to deny an interest deduction based on a perceived overall ineligible purpose for a loan. In addition, for spousal transfers in particular, it appears that the planning used by the Lipsons would be acceptable as long as the spousal rollover and therefore, the income attribution rules do not apply. [archived on April 29, 2009]

|

|

Stein v. Stein, 2008 SCC 35

[equal division of liabilities between estranged spouses in divorce]

|

|

Wayne Stein and Malka Stein of British Columbia separated in 2003 after 12 years of marriage during which the wife remained home to care for their two children. The Supreme Court of Canada handed down the decision on June 12, 2008 that the Court of Appeal's order be set aside and held that contingent tax liabilities should be shared equally by the estranged spouses. This sets a new benchmark in family law regarding division of contingent liability.

[archived on May 1, 2009]

|

|

Canada v. Prevost Car Inc., 2009 FCA 57

[beneficial owner: dividends, shareholders, tax authorities lost appeal in beneficial ownership case]

|

|

On February 26 2009, the Federal Court of Appeal upheld the decision of the Tax Court of Canada in the case of Prevost Car Inc. v. The Queen, 2008 TCC 231.

The only issue before the court of appeal was the interpretation of the term "beneficial owner" in the Canada-Netherlands treaty. Lower tax court ruled that the beneficial owner of a dividend is the person who assumes and enjoys all attributes of ownership of the dividend, including control of the dividend received. The court of appeal affirmed this interpretation.

The Crown's argument that beneficial owner should be the person who ultimately benefits from the dividend was rejected. The court stated that such a pejorative view of holding companies had not been adopted under Canadian law nor by the international community.

The Prevost decision is a welcome reaffirmation that choosing to locate a holding company in a tax-efficient jurisdiction is a legitimate tax planning. [archived on May 18, 2009]

|

|

Dagenais v. The Queen, 1999 CanLII 557 (T.C.C.)

[tax income: foreign capital gains tax from lottery paid is not deductible in Canada]

|

|

Jacques Dagenais appealed against the assessment from CRA regarding the deductibility of U.S. capital gain tax paid from winning lotteries in 1995.

The tax court held that foreign tax paid in this circumstance is not deductible in Canada citing that lottery gains within the meaning of paragraph 126(1)(a) of the Income Tax Act are not taxable in Canada. Double dipping is improper. The appeal was dismissed on March 22, 1999. [archived on May 21, 2009]

|

|

Li v. The King (Neutral citation 2023 TCC 77)

[tax income, employment expenses]

|

|

Yin Li appealed against denial under the federal Income Tax Act (Act) of claimed employment expenses of $55,945 and $50,793 respectively for his 2015 and 2016 taxation years.

The tax court dismissed his appeal due to a lack of T2200 Declaration of conditions of employment, bona fide payments of employment expenses claimed. [archived on 16 April 2024]

|

|

Porisky v. The King, 2024 TCC 84 (CanLII)

[tax evasion, counselling others to evade taxes, jail sentence]

|

|

Russell Porisky of Chilliwack and his common law partner Elaine Gould were first tried on tax charges in 2012. Porisky advocated a theory that centered around what he described as a "natural person." He argued the government's legal definition of a person (someone who votes, owns property, receives benefits and pays taxes) is artificial, and by merely declaring themselves "natural" people, one could avoid paying taxes. They were found guilty at their first trial. They appealed and argued that they should have been tried by a jury, rather than by judge alone. In 2014, the B.C. Court of Appeal ordered a new trial in the case. On 29 July 2016, B.C. Supreme Court convicted and sentenced Porisky and Gould to 5 and a half years and one day in jail after she received six months' credit for time previously served respectively. Gould was also fined $38,241 for one count of tax evasion.

After a decade long legal battle, the tax court decision on the appeal dealing with the tax assessment of their company Paradigm Education Group activities was handed down on 7 June 2024 quashing most of their appeals with costs. [archived on 6 July 2024]

|

Enns v. Canada, 2025 FCA 14

[Section 160 of the Income Tax Act, definition of spouse]

|